Discover the faster, easier way to financial consolidation, control and convenience

Discover the faster, easier way to financial consolidation, control and convenience

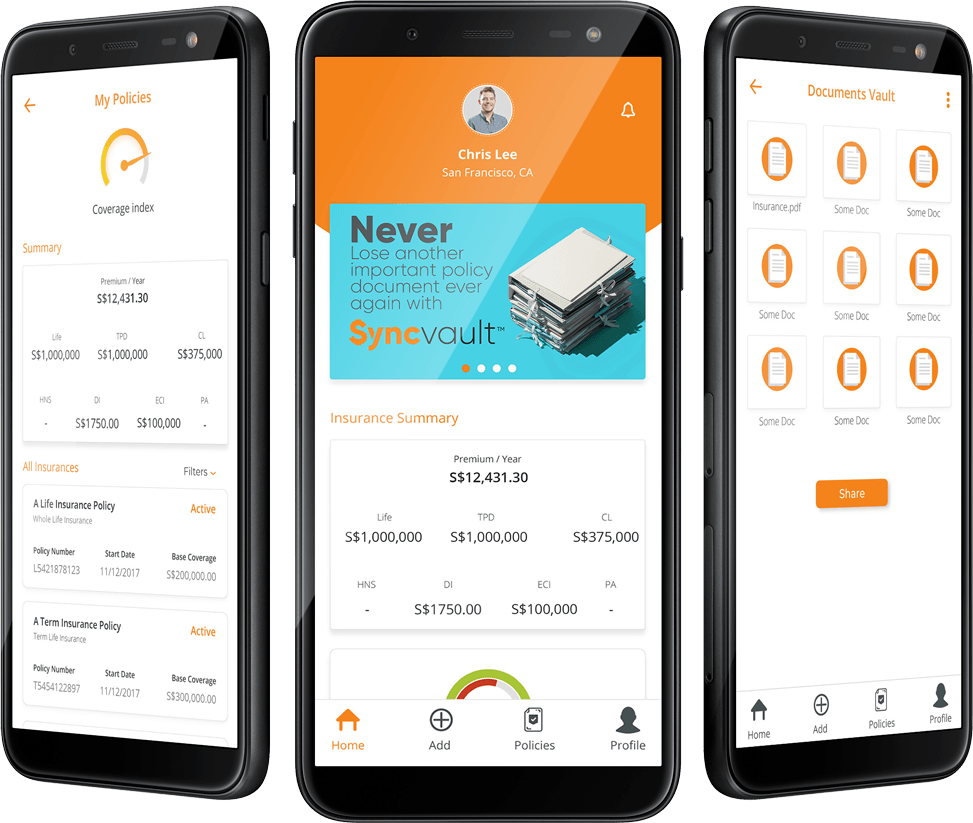

Are you still logging in to multiple online accounts, or digging through old boxes to find your contract documents? Whether it’s investments, insurance, or your stock portfolio, you can finally have them all on one platform. You will never forget what you’re investing in, and when that deduction for your insurance policies are due. Just link up with your favourite adviser, and you don’t even have to key in a single thing yourself.

No more wondering how much you’re insured for, which company sold you that alternative investment, or how that unit trust you have has performed over the last 7 years. SyncWealth supports all asset classes from any company. Need more details about that policy you vaguely remember? Full details are only 1 tap away. Just want to have an overall summary? It’s right there too. Need to know how prepared you are for retirement? We’ve got you.

Set your financial goals, monitor your progress, walk that journey. We believe financial products should never be sold, they should only be professionally prescribed. We help you with your goals and shortfalls so that you can work with any adviser you like who can recommend the right vehicles to get there.

No one likes mess and uncertainty when it comes to our finances.

We hated that we were losing documents, wondering why our credit card was charged, or worse still, missing a payment on important insurance policies.

We know these financial products are important, because we all want to achieve our financial goals! We wanted to stay on track to retirement, and we know you do too!

And we wanted to do it without logging into multiple platforms, struggling with paper statements, or even bad handwriting.

SyncWealth helps you to consolidate and remember these troublesome details so you don’t have to.

We don’t always want to go into the details, that’s why simplicity is our main goal.

You can choose to manage your portfolio yourself, or even work with a trusted financial professional. By connecting to your own consultant or adviser, you don’t even have to lift a single finger. You can now work hand in hand with him/her to ensure you’ll always be in control of your own finances.

With Our Insightful Articles, Now You Can Learn As Part Of Your Financial Journey

We don’t think we can afford to wait on their financial goals, so why should you?

Download the app right now, connect to your trusted financial consultant, and start enjoying clarity, control, and convenience in your finances!